The quintessential British brand with its immediately recognisable check pattern is in a spot of financial bother.

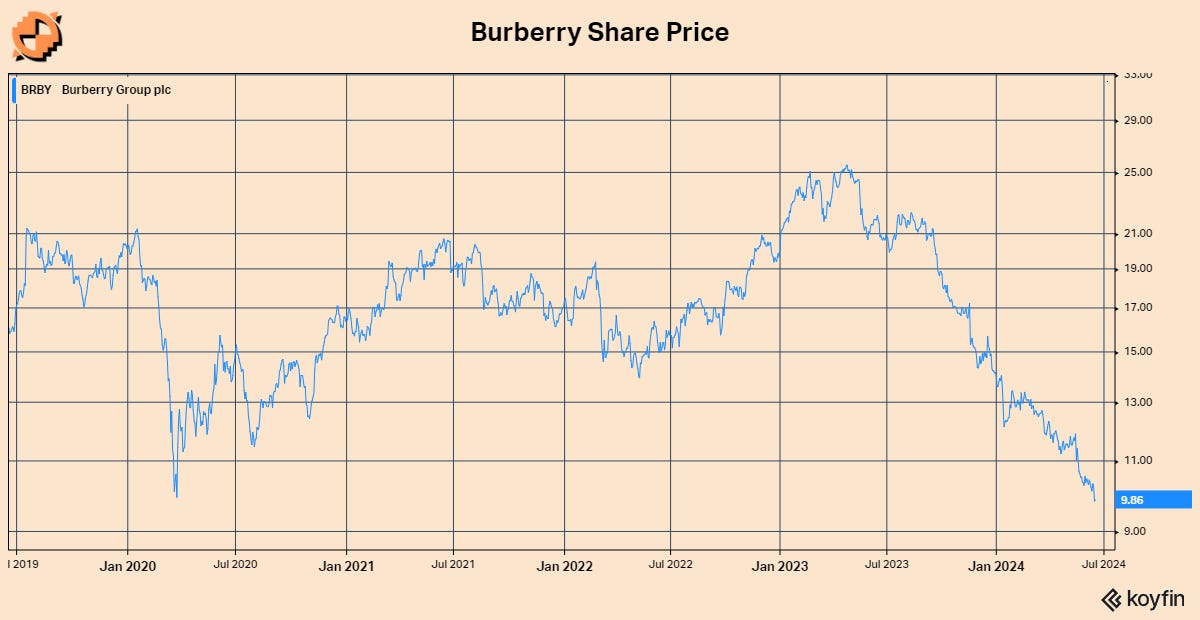

Burberry’s share price has been taking a steady tumble since April last year, falling from a peak of around £25 a share down to below £10. This is back to levels seen during the COVID-19 pandemic.

This has been driven by increasingly uninspiring earnings. For the latest financial year to March 2024, revenues were flat as compared to the prior year when adjusting for foreign currency changes. Profitability fell markedly with operating profits down -25%, with operating margins down from 20.5% to 14.1%.

It appears that these poor results are partly as a result of the slowing economic picture, with higher overall consumer living costs starting to eat into significantly into disposable incomes. Burberry noted that sales in the US were down -12% year on year. Additionally, the Chinese economic slowdown is materially impacting sales in Asia, with China being a significant growth market for luxury brands up until recently.

Getting Back on the Horse

Burberry have made changes to its creative direction and the company’s operations in a bid to turn things around.

The company hired Daniel Lee, former creative director of Bottega Veneta, to be the Chief Creative Officer and begun revitalising the company’s product line from the Autumn/Winter 2023 season.

Lee had been particularly successful at Bottega Veneta, capitalising on the brands most iconic features and increasing desirability. Burberry have been are hoping that Lee can bring the same to the brand.

Burberry are in particular looking at highlighting the inherent Britishness of the brand as part of the refresh.

On the product and revenue side of things, Burberry are hoping to grow revenue to GBP 4bn, with a doubling of leather goods sales, more than doubling shoe sales, doubling women's ready to wear and growing outerwear by 1.5x.

To improve productivity the company will look for efficiency and productivity gains, by improving store productivity, increasing online sales and enhancing store visibility through refurbishments.

Inconsistent Strategy

An improvement in earnings comes from three broad outcomes: increasing sales volumes, increasing prices or improving profitability.

Price

Given the likely deeper pocketed customers of Burberry’s luxury products, there is probably room to increase prices marginally, however larger price increases are not possible in the short term unless there is a significant increase in product desirability.

The macroeconomic environment is tough, we are seeing a consumer slowdown as evidenced by the company's US and Asia results. The cash Americans had amassed in the pandemic is beginning to run out under the strain of rising interest rates and shrinking disposal incomes. Price will play an important part of the consumer’s decision, even luxury consumers.

Daniel Lee's new collection was overall at a higher pricing point, and despite this, there has been little positive impact on revenues for the second half of the financial year. This GBP 1,390 glorified Bag for Life is a case in point.

Volume

Expanding sales volumes will likely impact scarcity which is one of the main selling points for luxury products. If there is a flooding of the market of Burberry goods, there will naturally be a price depression.

The impacts of this were seen in the UK in the early 2000s when there were floods of counterfeit Burberry products and the check pattern became synonymous with chav culture. It took years for the brand to recover.

How far the increased volumes can be pushed before a price impact is difficult to say, however, I would guess Burberry is already at or close to that point.

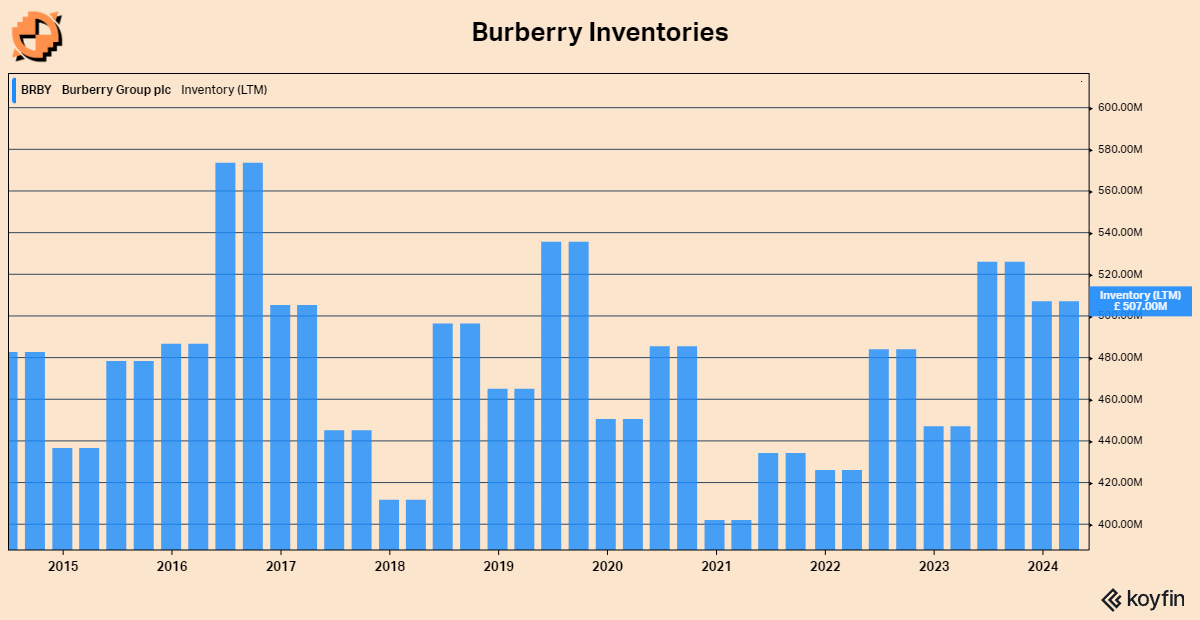

Inventory, despite flat to down sales figures, is up significantly and has been steadily rising. Financial year 2023 inventory was GBP 405m vs GBP 507m for 2024. If there was still room to materially increase sales volumes, I would expect inventory at the very least to be flat with year on year sales flat. For the existing product range, the slack to increase sales volumes materially isn't there.

Higher inventory levels is a natural drag on profitability with more stock having to be sold at discounted prices to keep stock moving. This was a material driver of the fall in profitability over the past year.

What high inventory levels also does is tie up cash, which is needed as part of the broader development of new lines and store refurbishment plans, This is why we have seen debt rise and the company recently issue a new bond. Burberry is cash generative and far from default risk, but it is clear there is a tightening of liquidity which could impact its ability to carry out the turnaround strategy.

The only other way to expand sales volumes is through new product lines, which is clearly part of the strategy. Focusing on leather goods and shoes as a growth engine and keeping the main Burberry offering of coats and scarves untouched.

However, that is a very competitive market, with plenty of established leather goods brands already. Burberry won’t necessarily be able to compete on the strength of its brand, since that is one of the main current issues it is facing with its existing products. It won’t be able to compete on quality, it will take time to catch up to the offering from the more established leather goods brands. Could Burberry compete on price? We have just highlighted the need for Burberry to achieve a higher pricing model, which price competition would go against.

Given the current market environment and recent performance I see a strategy of pushing sales volumes in both its existing product range and new potential ranges very challenging.

Costs

On the costs side, it is very difficult to see how to materially reduce costs beyond simple efficiency gains.

The luxury goods will need to continue to be made from the best products and best craftsmanship to justify their price and strengthen the brand. No opportunity here to cut corners.

There may be room to move when it comes to making stores and distribution more efficient and boosting online sales. Online sales naturally have a lower cost base (particularly compared to the higher cost physical locations) and scale much easier. However, there is a tricky balance when it comes to online luxury product sales. How much money is a consumer willing to spend on a product without physically seeing it. There is a fundamental limit on how much luxury goods can be sold online in my opinion.

A Better Way to Get Back on the Horse?

If you have read this far, you probably have worked out that I am not optimistic when it comes to Burberry’s turnaround plan.

Targeting an overall higher price point and higher volume strategy looks very challenging, particularly given the current economic environment.

I believe Burberry should be taking into consideration the broader consumer with its strategy and be more patient. Focus should be in the near term on profitability, in particular with efficiencies on the distribution and sales side. Refurbishments and improving shop floors to increase revenue per square metre is a must.

I also believe that they are heading into a tricky situation when it comes to inventory. The cash that is tied up in inventory is cash that could be used elsewhere, in particular for the refurbishment effort. The longer inventory is held at higher levels, the more likely it will have to be discounted in future and impact profitability. An active management of inventory will not only act as a profit protecting mechanism but also protect the value of the brand itself.

Ambitions to charge ahead and increase prices, volumes and the product range should be put on hold for now. Focus should be on continuing to strengthen the brand’s image and protect profitability to as to not jeopardise the ability to aggressively push when the time is right.

Aldo Rado